Advertisement

If you’re looking to buy a house, don’t let the process intimidate you; if you know what to expect, it can be relatively easy and straightforward. One of the most important parts of buying a house is getting your financing in order.

This will entail choosing your lender, filling out an application and getting pre-approved for your loan, applying for the loan itself, and finally closing on the house. Fortunately, there are certain steps that you can take to make this process go as smoothly as possible

Do your research

How much can you afford? What are the interest rates for various lenders? What’s your mortgage payment going to be each month? How long will it take to pay off your loan?

Advertisement

Understanding all these numbers is important when deciding on how much money you can borrow, as well as where you want to live.

Using a mortgage calculator or talking with an expert can help you figure out how much house you can really afford and find out if taking out additional loans makes sense.

Do check the EMI rate with your bank

The point is to make sure that your outgoings do not exceed your income. Even if you don’t want to include it in your budget, add up all your expenses, including those from interest payments on loans.

For example, if you take a home loan for Rs 50 lakh and make EMI payments worth Rs 60,000 per month over 20 years (excluding other expenses), it will cost you around Rs 2.6 crore!

Check what are you signing up for

Before you sign any contract with a bank, be sure to carefully read all the fine print. Remember that nobody is looking out for your interests but you, so make sure you know what kind of loan you are actually taking.

Know what all fees there are so that they don’t catch you off guard later on. It’s also best to read up on how interest rates work if it isn’t something that comes naturally to you.

Make sure you can repay the loan when you want to

Before you get approved for a loan, make sure that you can repay it when you want to. If your income changes at all, check with your lender and ask if you need to reapply.

If there’s ever a delay in making your mortgage payment, try to pay more than what’s required; that way, at least part of your payment will go toward interest while the rest reduces your balance so you won’t have to worry about missing any payments.

Know your purpose behind taking a home loan

What is your goal for taking out a home loan? Does it have to do with increasing liquidity or acquiring an asset with equity? Do you want to purchase multiple properties, or just one house that you plan on living in for quite some time?

These are all important questions to ask yourself before taking out any sort of home loan. Your answers will determine how much money you need, how long you’ll be paying off your debt, and if it’s really worth it for you. The last thing anyone wants is regret.

Understand your financial strength

Before applying for any kind of loan, you must assess your financial stability. Make sure you’re in a position to service both your debt obligations as well as day-to-day living expenses over time.

It’s also important to have funds set aside for emergencies. Keep in mind that applying for new loans will have an impact on your credit score, so make sure you take it into account before deciding whether or not to go ahead with it.

Have an emergency fund ready.

Weathering emergencies-and saving money on interest costs at the same time—is what homeownership is all about.

You can’t get any more basic than having an emergency fund in place before you sign your loan. Having cash set aside takes away some of your monthly expenses, leaving less money to service debt.

In case you take EMI, check if it includes all charges

Your EMI doesn’t just include interest. It also includes costs such as processing fees and taxes. So, it’s important to check with your bank or housing finance company if these charges have been included in your EMIs so far.

If not, start paying them separately by increasing your EMI payments now, so that you can save some money later on.

Compare loans available in the market; don’t commit too early

Comparing home loans is easy, but remember, you need to know exactly what you’re getting into. While it’s important to be quick on your feet and make an offer on that dream home while it’s still available, don’t make any hasty decisions if you can help with it.

Explore all your options before making up your mind! Do enough research to feel confident about your decision.

Read the fine print before signing on the dotted line.

When you’re buying a home, it can be easy to get caught up in all those exciting details: picking paint colours, taking measurements, and maybe even talking about whether or not to put up crown moulding.

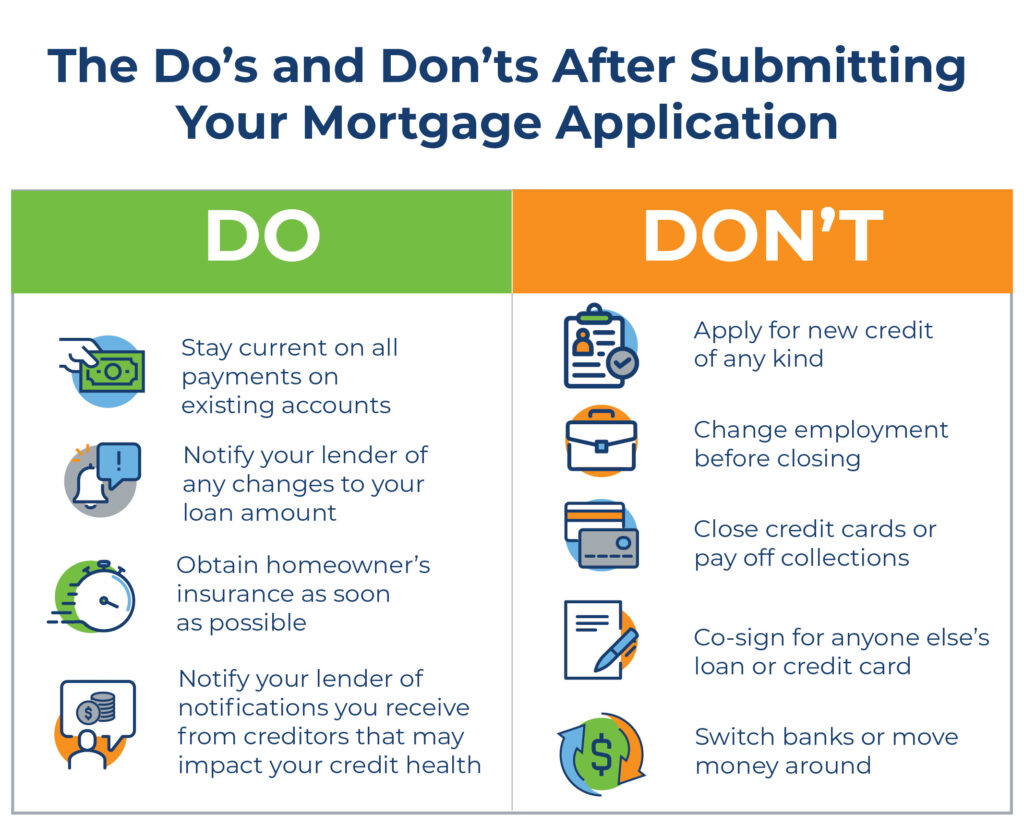

Before you take out your first home loan though, it’s important to educate yourself on some of its less glamorous aspects—like interest rates and points. To help you decide if one is right for you or not, here are some dos and don’ts when it comes to taking out your first home loan.

Advertisement

by

Tags:

Leave a Reply